The Ventura Pranas Quarterly Newsletter (January – March 2023)

Contents Overview

- Announcements

- India Budget highlights

- Crypto taxation and FEMA position

- You Ask, We Answer

- Parallel Universes

- Prabha’s Office Location

To stay posted on all tax law updates, follow us on LinkedIn

Announcements

Dear Clients,

As we just finished the first tax season of the year 2023, we write to you to give you a backdrop of everything that we have put in motion and to give you visibility into what this means to you as a client.

One significant step this year different from last year is that we are now working with our Trichy production office fully in force. The Senior Members of our team have been spending time and effort in grooming and training the talent.

Other changes we’re making include a single-point-of-contact (SPOC) methodology of servicing clients. For our clients who work with both accounting as well as tax services, we will designate a single point of contact for that client, and that person will coordinate across team members to ease communication, ensure periodicity and completeness of data and information sharing between departments.

We have also rolled out the first of a series of Webinars that we have planned to do once every few weeks. We will be doing two runs of each Webinar. One for our clients in PST and CST and another for our clients and friends in EST and IST. We would love to hear from you on what you would like us to cover. Please feel free to send your recommendations and requests to contact@venturapranas.com or ea@venturapranas.com. We will also be providing the links to the recording to those of our clients who registered for the event and could not attend because of reasons beyond their control.

We will be rolling out our new and improved Web portal soon. This will facilitate notifications to clients on upcoming deadlines and document requests.

Finally, as part of our plan to increase our engagement with clients we would like to do so with more time spent in Bangalore both in terms of face to face meetings. We will be sharing with you our schedules. We also will be conducting an event in Bangalore to meet with them while sharing information. Read on to register for our event in August.

Seminar on August 4, 2023

We’re doing a seminar in Bangalore’s Central Business District on August 4th (Friday), to discuss how companies in India can take their business outward to the US and Singapore. A venue will be finalized soon.

Present at the seminar we will have in discussion, an immigration lawyer, Rebecca Bodony, a Singapore corporate and Individual Tax & Accounting specialist, Mirah Augus and our director & CEO, Prabha Srinivasan.

Specifically in relation to expansion overseas, we will cover tax implications and structuring considerations, both from a corporate and an individual standpoint. We will also cover immigration related queries you might have in this regard for both USA and Singapore.

If you’re interested in attending, do send in an email to register at ea@venturapranas.com

Budget Impact

The Indian budget 2023 has significant changes in taxation brackets. We’re covering the highlights in this section so you have a sense of how this could affect you.

Highlights

- The new Tax Regime has been made the default tax regime from April 1, 2023.

- Revised tax rates have been proposed under New Income Tax regime for AY 2024-25.

Tax rates under old and new tax regimes

*Note: There is no change in Health and Education cess** No change in tax rate for companies or firms

| Income Tax Rates (in %) | Previous Income Slab (Rs. in Lakhs) | New Income Slab (Rs. in Lakhs) |

|---|---|---|

| NIL | 0- 2.5 lakh | 0-3 lakh |

| 5% | 2.5-5 lakh | 3-6 lakh |

| 10% | 5-7.5 lakh | 6-9 lakh |

| 15% | 7.5-10 lakh | 9-12 lakh |

| 20% | 10-12.5 lakh | 12-15 lakh |

| 25% | 12.5-15 lakh | - |

| 30% | Rs. 15 lakhs & above | Rs. 15 lakh and above |

- The new Tax Regime has been made applicable to association of persons, body of individuals or artificial juridical person.

- Rebate under section 87A, available on a total income up to Rs 7 Lakh instead of Rs 5 lakh in case of New Tax Regime.

- Standard deduction of Rs. 50,000, deduction from family pension & deduction under section 80CCH for amount paid towards Agniveer Corpus is allowed as deduction in the New Tax Regime.

- Surcharge has been reduced to 25% for income beyond Rs. 5 Cr in case of New Tax Regime as opposed to the erstwhile 37%

- For opting Old tax regime, an option has to be exercised before the due date of furnishing the return.

- The standard deduction of Rs 50,000 (Sec16) has been extended to the new tax regime as well and deduction from family pension up to Rs. 15,000(Sec 57).

- Reduce the highest surcharge rate from 37 per cent to 25 per cent under the new tax regime.

- Maximum tax, along with surcharge, will be 39% (MMR), earlier it was 42.74%

- Budget 2023 makes new tax regime default option but old tax regime to remain available – 139(4)

- Rebate limit increased to 7 lakh in new tax regime

- Note : No Rebate for LTCG u/s 112A

- For pensioners, the finance minister announced extending the benefit of standard deduction to new tax regime.

- Each salaried person with an income of ₹15.5 lakh or more will benefit by ₹52,500.

Other points to note:

Deduction to be allowed only on actual payment to MSME

A new clause (h) in section 43B of the Act has been inserted to provide that any sum payable by the assessee to a micro or small enterprise beyond the time limit specified in section 15 of the Micro, Small and Medium Enterprises Development (MSMED) Act 2006 shall be allowed as deduction only on actual payment.

It is also proposed to amend the proviso to section 43B so as to not allow the deduction on accrual basis, if the amount is paid by due date of furnishing the return of income in the case of micro or small enterprises.

Increasing threshold limits for presumptive taxation schemes

Section 44AD provides for presumptive taxation for small businesses. Section 44AD has been amended to increase the threshold limit to Rs. 3 Crores where the amount received during the previous year, in cash, does not exceed 5% of the total turnover or gross receipts.

Section 44ADA, which provides presumptive taxation for small professionals, has also been amended to provide that where the amount received during the previous year, in cash, does not exceed 5% of the total gross receipts, a threshold limit of Rs 75 Lakhs will apply.

Corporate Tax

Sec 56(2)(viib) to be applicable to Non Residents as well. Consideration received for issue of shares by a company (in which public is not substantially interested) from a Non Resident in excess of Fair market value shall be chargeable to tax under Income from other sources.

Time limit for bringing export proceeds in India: Deduction u/s 10AA(sale of goods or provision of services by SEZ) to be allowable only if sale proceeds in forex is received in India within 6 months from the end of relevant Previous year

Providing clarity on benefits and perquisites in cash: It has been clarified that benefit or perquisite specified u/s 28 (chargeability under head PGBP) includes provided in cash or in kind or partly in cash and partly in kind and also TDS will be applicable u/s 194R on such benefits or perquisites.

Removal of certain funds from section 80G: Three earlier allowable deductions have been removed from section 80G, which means they are no longer 100% deductible.

Jawaharlal Nehru Memorial Fund

Indira Gandhi Memorial Trust

Rajiv Gandhi Foundation

Market Linked Debentures

It is proposed to insert a new section 50AA in the Act, to treat the capital gain arising from the redemption or maturity of the “Market Linked Debentures” , as capital gains arising from the transfer of a short term capital asset. It would be taxed at applicable rates from AY 2024-25 onwards.

TDS and TCS

Increasing rate of TCS of certain remittances : TCS on overseas tour package has been increased from 5% to 20%.

TCS in any other case, other than medical and educational purposes, has been increased from 5% to 20%.

This applies to Resident Indians and not to Non Resident Indians.

Crypto Taxation: Some of our clients have been asking us to cover Crypto and its tax impact in US and India. We have endeavored to do so here

Cryptocurrency is any form of currency that exist digitally or virtually and uses cryptography to secure transactions It is a digital payment system that doesn’t rely on banks to verify transactions. It’s a peer-to-peer system that enables anyone anywhere to send and receive payments.

Since cryptocurrency can be used to purchase, it is treated, as the name suggests, as an asset and therefore it is taxable. Cryptocurrency is stored in digital wallets, recorded on a public ledger that is distributed (the distribution of it and the public nature of it is the unique technology that we refer to as block chain).

Typically, if you are paid in crypto by an employer, it is taxed as compensation according to your income bracket, but if you are getting crypto in exchange for products or services you provide, you must treat this as income.

In this section, we’ve covered how crypto currency is treated – in relation to taxation – in both India and the US.

Crypto currency impact in India

Crypto is taxed in India at a flat rate of 30% on gains received in the short and long term (plus an applicable surcharge and 4% cess). Private investors, commercial traders, and anyone else who transfers Crypto assets in a given fiscal year are subject to this tax.

Things to be considered in crypto:

-

No deduction under chapter VI-A or an exemption under section 54F shall be allowed for such capital gains. However, relief under the section 87A can be claimed.

Note: Sec 87A – Must be a resident of India, the limit of rebate is 12,500 and Can be claimed only if a taxpayer has a total income minus deduction is less than or equal to 5 lakhs. -

Only the acquisition cost can be deducted

Which is Taxable Income = (Selling Price – Purchase Price). - Loss arising on transfer of virtual digital asset cannot be adjusted against any other income.

When does the tax liability arises?

Under 3 circumstances

- If a person receives a VDA (Virtual Digital assets) without consideration and the fair market value of that VDA exceeds INR 50,000 – the entire fair market value of the asset is considered taxable income in the hands of the person who received the VDA.

- If a person receives a VDA for consideration lower than the fair market value, and the fair market value exceeds the consideration by more than INR 50,000 – the difference between the fair market value and the consideration paid is considered taxable income in the hands of the person who received the VDA.

- If a person earns income from the transfer of a VDA – the income earned by that person less the cost of acquisition, if any, is subject to tax at the rate of 30%. Additionally, an equalization levy of 2% will be levied on the non-resident owner of the block chain on which NFTs are traded.

In both the situations, the limit of Rs. 50,000 shall be checked for every transaction and not in aggregate of all transactions.

TDS on Crypto currency:

- • A new section 194S is introduced for the deduction of TDS on the transfer of virtual digital assets. This provision is applicable from 01-07-2022.

- • Any person buying VDAs or cryptocurrency must deduct a TDS of 1 percent of the total amount paid to the seller, according to section 194S of the Income Tax Act.

- • During the non-availability of the seller's PAN, the tax will be deducted at source (TDS) at 20%.

TDS attracting to Crypto:

- • The total amount of transfer of VDAs by the specified person during the financial year exceeds Rs 50,000.

- • The total amount of transfer of VDAs by anyone other than the specified person during the financial year crosses Rs 10,000.

Specified persons includes- from any relative or on the occasion of the marriage of the individual or under a will or by way of inheritance or due to the death of the payer or donor or from any local authority or by any trust or institution registered under section 12Aor section 12AA or section12AB

Surcharge rates on Crypto

The rate of surcharge applicable on the shoet-term captal gains from the transfer of virtual digital assets shall be as follows:

1.Rate of Surcharge in the case of Indvidual, HUE, AOP, **BOI or AJP

| Nature of Income | Range of Income | ||||

|---|---|---|---|---|---|

| UP to Rs.50 lakh | More than Rs.50 lakh but up to Rs.l core | More than Rs.1 core but up to Rs.2 core | More than Rs.2 core but up to Rs.5 core | More than Rs.5 core | |

| Long term capital gain | Nil | 10% | 15% | 15% | 15% |

| Short term capital gains | Nil | 10% | 15% | 25% | 37% |

| Any other income | Nil | 10% | 15% | 25% | 37% |

Taxation under the head of business Income.

• If the transactions in virtual digital assets are frequent and substantial, it should be held that the taxpayer is trading in such assets. In this scenario, income from the sale of such assets should be taxable as business income. The gains (without deduction of any expense or allowance) shall be taxable at the flat rate of 30% plus surcharge and cess.

Taxation under the Head of other sources. Section 56(2)(x)

• As per the sec 56(2)(x) applies when any person receives benefit whose value exceeds Rs. 50,000. This provision is applicable not based on the residential status or class of assessee. The donor or donee can be an individual, partnership firm, LLP, company, AOP, BOI, co-operative society or artificial juridical person, whether resident or non-resident.

Under the Section 56(2)(x)

The Finance Bill, 2022 proposes to include virtual digital assets within the scope of movable assets.

if a person receives a virtual digital asset without consideration (gift) or for inadequate consideration and the value of such benefit exceeds Rs. 50,000, it shall be taxable in the hands of the recipient under Section 56(2)(x) as income from other sources.

FMV value of Virtual assets under the 56(2)(x) shall be determined with 11UA.

- • If purchased from registered dealer the invoice value of such asset shall be its fair market value.

- • the virtual digital assets are received by any other mode (i.e., mining, etc.) the FMV of such asset shall be estimated to be the price that it would fetch if sold in the open market on the valuation date.

Treatment of Losses of Crypto (2022):

-

No set-off and carry forward allowed to losses from virtual digital assets

Section 115BBH(2)(b) provides that no set-off of loss from the transfer of the virtual digital asset computed shall be allowed against income computed under any other provision of this Act to the assessee, and such loss shall not be allowed to be carried forward to succeeding assessment years.

For instance, the short-term capital loss from the sale of a cryptocurrency cannot be set-off against the short-term capital gains of the sale of listed shares. Similarly, the long-term capital loss from the sale of NFTs cannot be set-off against the long-term capital gains from the sale of mutual funds.

However, short-term capital loss arising from the transfer of Ethrum (cryptocurrency) can be set-off against short-term capital gains arising from the transfer of bitcoin or an NFT.

Short term Crypto/ Long term Crypto,

- • A crypto is considered as short term when its holding period is less than 12 months and long term is holding more than 12 months.

Crypto currency impact in the US

IRS Considers crypto as a property and the capital gains and losses which you derived from that need to be reported on Schedule D and Form 8949 if necessary.-

1. Holding Period for short term and Long Term

• For Short Term – HP – One year or Less.

• For Long Term – HP – More than one year. -

2. Method of Taxation

• STCG on crypto taxed as ordinary income rate.

-

• LTCG on crypto subject to LTCG taxes.

-

3. Other Relevant Information- • You can also earn income related to cryptocurrency activities. This is treated as ordinary income and is taxed at your marginal tax rate, which could be between 10 to 37%.

- • You can set off the losses with gains and if there are any excess losses that can be carry forward to next year.

- • Cryptocurrency mining refers to solving cryptographic hash functions to validate and add cryptocurrency transactions to a block chain. In exchange for this work, miners receive cryptocurrency as a reward. It is considered as taxable income and might be reported on Form 1099-NEC at the fair market value of the cryptocurrency on the day you received it. You need to report this even if you don't receive a 1099 form as the IRS considers this taxable income and is likely subject to self-employment tax in addition to income tax.

- • An airdrop is occurring when they launch new crypto project. To promote that crypto project initially, they will give free crypto to the people who frequently interact with crypto platforms. If you receive airdrops, these coins will be taxable as ordinary income and it should be reported to the IRS.

- • Earning crypto as a reward for holding crypto currencies is the stake crypto currencies. Those reward will be taxable as an income and sub to SE taxes same as Mining crypto.

- • You can donate crypto to qualified charitable organization to claim a tax deduction. These are treated as non- cash contributions.

- • You can’t deduct casualty or theft losses.

- • For crypto transactions you make in a tax-deferred or tax-free account, like a Traditional or Roth IRA, respectively, these transactions don’t get taxed like they would in a brokerage account. These trades avoid taxation.

-

2022 Long-Term Capital Gains Tax Rates

| Tax Rate | 10% | 12% | 22% | 24% | 32% | 35% | 37% |

|---|---|---|---|---|---|---|---|

| Filing Status | Taxable Income | ||||||

| Single | Up to $10,275 | $10,276 to $41,775 | $41,776 to $89,075 | $89,076 to $170,050 | $170,051 to $215,950 | $215,951 to $539,900 | Over $539,900 |

| Head of household | Up to $14,650 | $14,651 to $55,900 | $55,901 to $89,050 | $89,051 to $170,050 | $170,051 to $215,950 | $215,951 to $539,900 | Over $539,900 |

| Married filing jointly | Up to $20,550 | $20,551 to $83,550 | $83,551 to $178,150 | $178,151 to $340,100 | $340,101 to $431,900 | $431,901 to $647,850 | Over $647,850 |

| Married filing separately | Up to $10,275 | $10,276 to $41,775 | $41,776 to $89,075 | $89,076 to $170,050 | $170,051 to $215,950 | $215,951 to $323,925 | Over $323,925 |

2022 Long-Term Capital Gains Tax Rates

| Tax Rate | 0% | 15% | 20% |

|---|---|---|---|

| Filing Status | Taxable Income | ||

| Single | Up to $41,675 | $41,676 to $459,750 | Over $459,750 |

| Head of household | Up to $55,800 | $55,801 to $488,500 | Over $488,500 |

| Married filing jointly | Up to $83,350 | $83,351 to $517,200 | Over $517,200 |

| Married filing separately | Up to $41,675 | $41,676 to $258,600 | Over $258,600 |

Sources:

1. https://turbotax.intuit.com/tax-tips/investments-and-taxes/your-cryptocurrency-tax-guide/L4k3xiFjB

2. https://www.irs.gov/businesses/small-businesses-self-employed/digital-assets

FEMA position on Crypto

Crypto Currency can be classified as goods and that is why if a Person is resident in India and he enters into a transaction with a resident outside India, it will be treated as export and import, and the Provisions of FEMA will apply to such transaction.

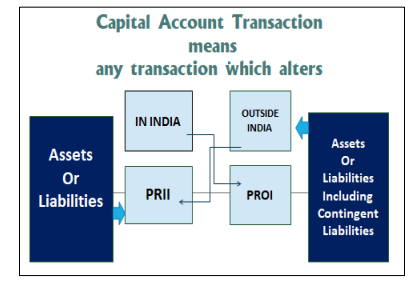

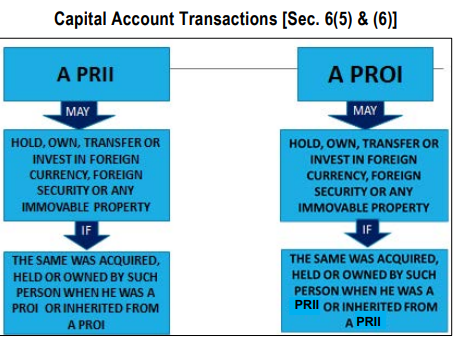

All Transactions with a Person resident outside India are Categorized under FEMA as either Capital Account Transaction or Current Account Transaction.

Classifying Cryptocurrency Transaction as Capital Account Transaction

A transaction that alters the assets or liabilities outside India of person’s resident in India (PRII) or vice versa. Example: In the case of the purchase of cryptocurrency by the buyer from a person resident outside India(PROI), the cryptocurrency gets transferred into the buyer's wallet along with the exclusive rights and the location of the assets will be India for all legal purposes. In the other case where the seller sells it to the person resident outside India and the cryptocurrency gets transferred to such person and the seller will have no rights. In both cases, the transaction does not alter the assets or liabilities of the seller and buyer outside India, and therefore, cannot be classified as capital account transactions.

Classifying Cryptocurrency Transaction as Current Account Transaction

Category 1- Purchase of Cryptocurrency from a person resident outside India through foreign exchange on payment by fiat currency to a person resident outside India or;

Category 2- Payment by Cryptocurrency to a person resident outside India for purchasing goods and services from a person resident outside India; or

Category 3- Payment for Cryptocurrency to a person resident outside India in consideration for acquiring other cryptocurrencies from persons resident outside India.

Therefore, any payment made or received in connection with a transaction of cryptocurrency by an Indian Resident with a person from any of the above categories will be considered as payment in the context of foreign trade and would fall under the classification of 'Current Account Transaction' under the FEMA.9

CROSS- BORDER TRANSACTIONS AND CRYPTOCURRENCY

-

• When the cryptocurrency is being transacted outside Indian Residents as a mode of payment of services rendered and goods sold by a non-resident, such transaction is most certainly to be classified as export of goods under FEMA.

-

• These regulations require the full value of any exports to be received only through authorized banking channels only and any set-off import payments to be received only through Bank. This leads to a situation where a cross-border barter would not be permitted.

-

• Therefore, a cross-border transfer by Indian residents involving cryptocurrency without any fiat currency through an authorized banking channel violates Export Regulation.

The Laws regarding Cryptocurrency is in Grey currently as it is not considered Currency or legal tender in India. The Enforcement Directorate of FEMA readily raids many Cryptocurrency exchanges operating India as they tend to violate the foreign exchange laws.

In conclusion, a Person resident in India entering into a transaction with a Nonresident for the trading crypto currency is certainly violating the foreign exchange laws of India. The regulations with regards to crypto currency are yet to be formulated in India and the regulation is expected to promote and regulate both domestic and international transactions dealing with cryptocurrency.

You Ask, We Answer (Theme : Real Estate)

There are some changes in real estate laws this year that can impact you very differently as compared to last year. In the form of questions and answers, we tackle a few different scenarios where our advice would have been different under the old regime, and now it has been modified based on the new budget.

What is the effective long term capital gains rate in India?

The new finance bill has capped the surcharge at 15% making the top rate applicable on Long term capital gains 23.92% Vs the erstwhile 28.5%.

Is the Long term rate of tax different for Real Estate Vs Stock in a closely held company?

No there is no difference. The rate of tax is the same. However, Long Term capital gains from the sale of unlisted shares by NRI will attract a tax at 10% instead of 20% (U/s 112)

I am selling closely held stock in 2023-24 FY and generating capital gains how much of the proceeds can I reinvest in a real property to be able to save on capital gains tax?

Under the latest Finance Bill the reinvestment has been capped at Rs. 10Cr. This means you can only save the capital gains tax on the proportion that the Rs. 10 Cr bears to the total proceeds. Remember the stock must be long term - which means you should have held it for at least 24 months.

Can I sell closely held stock in India and reinvest in a real property in the USA and avail the tax savings on the reinvestment?

No, this cannot be done. The laws are envisaged to promote reinvestment in real estate in India and not in the USA.

My wife and I jointly own a property that we are selling, can each of us avail the benefits under section 54EC, reinvestment in capital gains savings bonds?

Yes, you may both avail the benefits under section 54EC as this is tied to the taxpayer and not the asset that was sold. However, be sure to reinvest this with in 6 months and you cannot do this more than once for a single sale transaction.

If I sell real assets in India and I am a resident of the US. Do I still have to pay state taxes?

Yes, if you are a resident of a taxable state.

Can I avail foreign tax credits for taxes paid in India against taxes payable to states?

No you cannot avail credits for taxes paid in India against state taxes. The DTAA envisioned reciprocal credits for taxes paid at the federal level only not the state tax.

What is the TDS rate applicable for Resident seller & Non-Resident seller?

1% on the gross proceeds for Resident and 23.92% on gross proceeds for Non-Resident seller.

I am ROR in India and sold a property in US. Is the tax law any different in India for the US property sale?

The tax treatment is similar to as of the property sale in India.

Can the taxes paid in US state be claimed as the relief in India?

Yes, relief can be claimed under section 91 (Country with no DTAA).

Will my FTC (Foreign Tax Credit) carryover in general Category help in saving US taxes from India Cap gains?

No, The capital gains from India will be considered as foreign passive source income and FTC carryover from general category (salary, business etc.) cannot be used to offset the passive category foreign taxes.

I already have 2 residential properties in my name worth way lower in value? What are the dos and don’ts if I want to avail the 54F exemption up to 10CR?

One of the condition to claim 54F exemption is “At the time of transfer of assets, you could hold only one property other than the reinvestment property”. So, please transfer the excess house property (more than one), before the sale of intended property for which 54F exemption to be claimed.

Can I share my title with my family and increase repatriation limit $1mm per person?

Yes, you could. However, please be aware that the transfer / split the asset (without adequate consideration / gift) will attract consumption of your life time gift /estate exemption threshold. As well as, in India, if the recipient is not a relative / resident Indian, “the receipt of gift” more than Rs. 50,000 attracts tax at ordinary rate.

If I have existing real estate loss in USA, can that be adjusted against capital gain from sale of Indian property?

Yes, you could

If the property is purchased before 2001 and the actual purchase price is more than guideline value as on April 1, 2001, are we free to consider the actual cost as basis of the property to calculate gain / loss? Or it should only be the guideline value

The assessee has the right to choose either the guideline value or the actual cost whichever is beneficial to him / her under the Indian Income Tax law.

Parallel Universes

Stories and scenarios you can relate to, for families in the US and in India, to help you understand the complexity (and humour) involved in financial planning. Please note that the following is simply a case study. Any references to names and situations are entirely coincidental.

Natraj grew up in Chennai, back when it was called Madras, and forged close friendships with his school friends that have seen him through his life adventures until today. Around 20 years ago, he started a tech services company with his inner circle, but life took him in various directions and Natraj ended up moving to California to pursue other opportunities. He remained a co-founder on the company board, and although he was involved for the critical first years, after that it was his friends who continued to grow the company out of India. Natraj became a resident of California (CA).

This company is now perched for an IPO, and Natraj would like to know how best he can prepare for taxes, given the company is Indian and going public in India.

We advised Natraj to make a partial exit before the IPO, and then stay the course for 6 months after the IPO date, after which he will be eligible to sell in the open market in India.

The sale of stock pre-IPO would be closely held stock held by an NRI and eligible for the lower tax rate of 11.96% in India. In the US, Natraj would be liable for 23.8% at the federal level and he would need to pay the residue in the USA. Further, being a resident of CA he would need to pay CA taxes at 13.3% taking this worldwide tax bill to 37.1%

For the stock he holds after the IPO, Natraj would be eligible to the lower rate applicable in India for long term stock at 10% plus cess plus surcharge. However, his US tax bill will remain 37.1%

It is interesting to contrast this situation to another, that of Aarti, who is also from Chennai, an Indian citizen and resident, currently living in Chennai, but was a founder of a US data-analytics company with her friends from Stanford, where she did her undergraduate studies. Aarti felt compelled to move back to Chennai because his father was ailing and the family had a long established business in India she had to run. Aarti continued to hold her shares in her US company while her friends took the company forward. Now this data-analytics company is poised for an IPO on the NYSE.

We informed Aarti that she has an opportunity to make a mini exit to a private equity firm prior to the IPO and then has to hold onto the rest of her shares for the next 18 months, after which she is free to sell in the open market. The question is, how should Aarti look at her taxes in the US and in India. Since she is an NRA and spends practically no time in the US (by taxation laws less than 183 days is the criteria), she is not subject to tax in the US on gains from the sale of the capital asset. This is true of the initial stocks sold pre-IPO and the subsequent sale of stocks in the open market, and whether short or long term. Aarti would be subject to taxes in India only. Her taxation in India would be as per domestic laws per article 13 of the US India DTAA and would be at the rate of 23.92% assuming she’s held the stock for 24 months. Further, since Aarti wants to buy that home by the beach she’s been dreaming of for her and her parents, she can invest up to Rs. 10CR of proceeds in India and avail the exemption under section 54F. The fact that Aarti has not state residency in the US and is an NRA has saved her both state and the US Net investment income taxes.

To contrast both these cases, we turn to Salma, a resident of CA, who had started a banking services company about 20 years ago with her school friends in Chennai. Salma later decided to leave India to get a business degree and shift to consulting. She remained a cofounder of the business, but once she got busy with her studies, it was her friends and c0-founders who fine-tuned the company’s services until they expanded.

The company is now perched for an IPO and Salma would like to know how to be prepared for taxes given that the company is Indian and going public in India.

We advised Salma to make a partial exit before the IPO and will have to stay the course for 6 months after IPO date and then be eligible to sell in the open market in India.

The company issued bonus stocks on the multiples of original holding 6 months prior to the IPO. Salma now holds 10x of her original shares (say 1,000,000 shares).

50% of shares sold pre-IPO (500,000 shares).

For India tax calculation:

Original issuance of 100,000 shares sale will be considered as long term while the bonus issuance of 400,000 shares will be considered as short term (the holding period of 24 month is not satisfied). The sale of stock preIPO would be closely held stock held by an NRI and eligible for the lower tax rate of 11.96% in India for long term and 42.7% in India for the short term. For the stock she holds after the IPO, she would be eligible to the lower rate applicable in India for long term stock (6 months prior IPO and 6 month lock-in post IPO will satisfy 1 year holding for listed stock) at 10% plus cess plus surcharge.

For US tax calculation

The entire 500,000 shares sale will be considered as long term, as US counts the original purchase date of the original stock as the date for the bonus issuance.

In the US, Salma would be liable for 23.8% at the federal level and she would need to pay the residue in the USA. Further, being a resident of CA, she would need to pay CA taxes at 13.3%.

Her overall US tax bill will remain 37.1% on the entire sale proceeds.

As you can see the tax scenarios laid out above provide opportunities for tax planning and breaking residency from a state standpoint. If you think this applies to you and you are confused, call us and we will untangle some of this for you.

Prabha’s Office Location + appointments

Our director, Prabha Srinivasan will be in available for appointments in Bangalore, Singapore and Los Angeles over the next quarter. Below is her schedule:

Los Angeles: May 5 - 19 and September 9 - 17th

Bangalore : August 2 - 4 and June 5 - 6

Trichy: May 23

New York: August 18 - September 3

Singapore: July 19 & 20th, August 17 & September 19

To book an appointment, send in an email to ea@venturapranas.com , along with details of what you would like to discuss, as well as your time zone so we can schedule the call or appointment for an appropriate time.