By Ventura Pranas | 14/01/2025

The IRS has announced that individuals and businesses in southern California affected by the recent wildfires are eligible for tax relief. The affected parties now have until October 15, 2025 to file their taxes.

Relief is being offered to areas that are designated by FEMA. Currently, individuals, households and businesses in Los Angeles County are eligible for tax relief. Counties that are later affected by the disaster area may become eligible at a later date

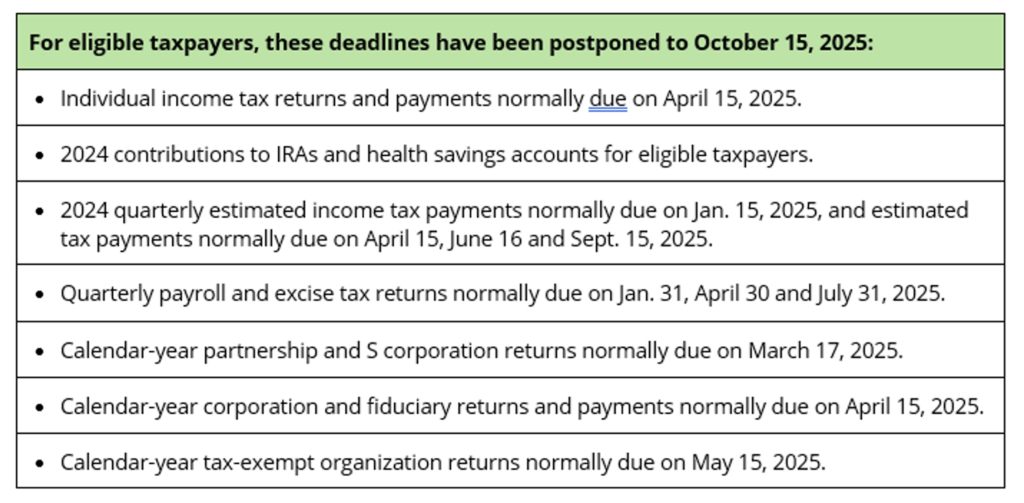

The tax relief postpones various tax filing and payment deadlines that occurred from Jan 7, 2025 through October 15, 2025 (postponement period). See the attached image for some affected deadlines.

The IRS automatically provides filing and penalty relief to any taxpayer with an IRS address of record located in the disaster area. If you do not have an IRS address of record (e.g. if you moved to the disaster area after filing your returns), and receive a penalty notice, call the number on the notice to have the penalty abated.

Individuals and businesses in a federally declared disaster area who suffered uninsured or unreimbursed disaster-related losses can choose to claim them on either the return for the year the loss occurred (in this instance, the 2025 return normally filed next year), or the return for the prior year (2024). Be sure to write the FEMA declaration number – 4856-DR − on any return claiming a loss.

In general, affected taxpayers can exclude from their gross income any qualified disaster relief payments received from a government agency for reasonable and necessary expenses.

Additional relief may be available to affected taxpayers who participate in a retirement plan or individual retirement arrangement (IRA). For example, a hardship withdrawal, or a special disaster distribution that would not be subject to the additional 10% early distribution tax and allows the taxpayer to spread the income over three years.

For more information on the tax relief scheme or filing requirements, connect with us at contact@venturapranas.com.

<script id=’formScript385330000000575029′ src=’https://crm.zoho.in/crm/WebFormServeServlet?rid=7a06aa0237b3be16835d9c8218fd33b0c71eadf39f6b13d7bdda8edf4826aadb207ee31129785a6986b2cc06025e2dbcgidb4ca60be4ba89712d5e07b51ae2858cf110b850329eea4c9de341829e90d6935&script=$sYG’></script>