Starting this month, we will provide insights from Union Budget 2024, as a response to the many requests on the topic by our clients. This is one of the posts in a multiple series of posts:

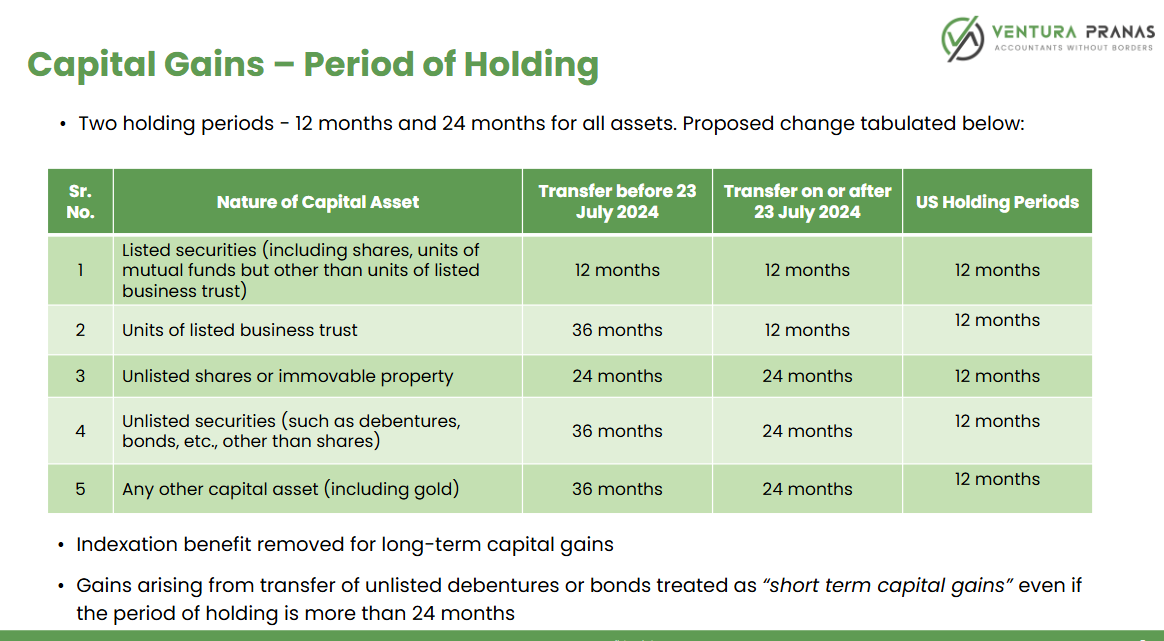

As can be seen from the slide, this article focuses on the period of holding concerning the Capital gains, and the period being: 12 months, and 24 months, and their outcomes, as well as the Indexation benefit having been removed for long-term capital gains. Gains arising from the transfer of unlisted debentures or bonds are treated as “short term capital gains” even if the period of holding is more than 24 months. We have contrasted Indian holding periods with US holding periods.

For more information on how the components of the new union budget would impact you, connect with us at :[email protected].

hashtag#crossborderaccounting hashtag#IPOIndia hashtag#Indiatax hashtag#USTax hashtag#FEMA hashtag#Capitalgainsta